🐊 The Soft Fork | Purchasing Power Compression

From Creature Playbook → Real Life Strategy

🐊 The Soft Fork | Purchasing Power Compression

The Setup: Why We’re Here

Every empire falls. That’s not pessimism — it’s historical pattern.

From Rome to Britain to the Soviet Union, money always breaks before society does. And when the currency collapses, the people who didn’t prepare become the collateral damage.

We’re living inside that cycle now. The U.S. dollar has lost ~90% of its purchasing power since the 1970s. What your grandparents could buy with four years of income — a house, some stability — now takes nine years or more. That’s not bad luck. That’s the system working as designed.

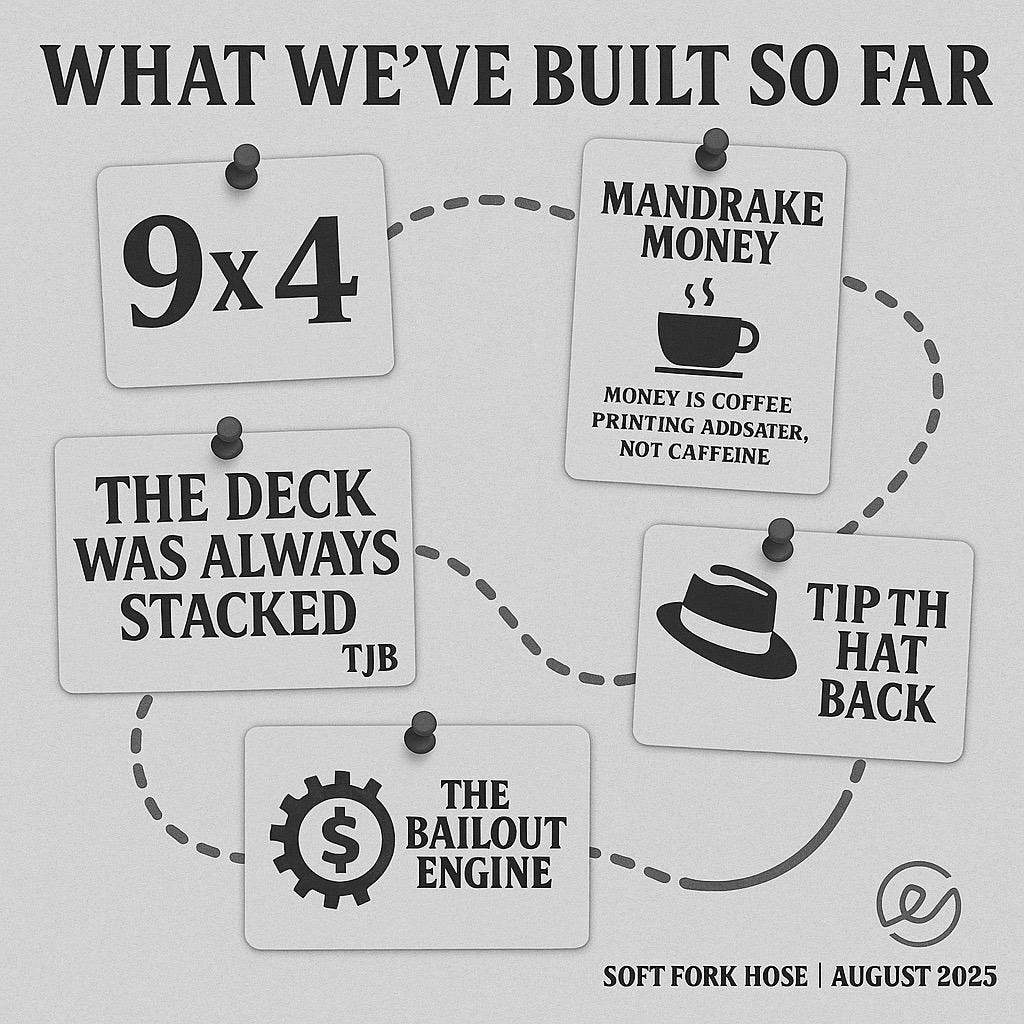

The Creature Playbook Recap

In my last post (The Soft Fork | The Creature Playbook), I laid out the script:

Mandrake Money → watered-down dollars, worth less every year.

The Bailout Engine → crashes aren’t bugs; they’re harvests.

Debt Is the Leash → the system keeps you chained by credit.

Feature, Not a Bug → inflation is engineered, not accidental.

That post was the decoder’s handbook — showing you the Fed’s cycle of boom → bust → bailout → harvest. Now it’s time to flip the script.

Purchasing Power Compression

Here’s the reality:

In 1970, the income-to-home ratio was ~4x.

Today, it’s ~9x or worse in many cities.

That means your dollar’s power has been cut in half again and again.

When the Fed prints, when banks inflate, when global demand for the dollar falls — your paycheck shrinks in real terms. That’s purchasing power compression.

And while the headlines scream about “inflation cooling” or “the Fed cutting rates,” the long-term trend is undeniable: your money buys less, your debt costs more, and the leash tightens.

How to Flip It: A Practical Reversal

We can’t fix the Fed. But we can reverse how much control it has over us:

Big Down, Small Mortgage

Put more money down upfront. Equity shields you from inflation. The smaller your loan, the less leverage the Fed has on you when rates spike.Own More, Owe Less

Debt is the leash. Paying it down isn’t just financial — it’s freedom.Build Reserves

90 days of food, power, and essentials = security buffer. You don’t panic when supply chains crack.Hedge Wisely

Gold, silver, and crypto aren’t speculation here — they’re insurance against a system built to dilute your savings.Form Your Cell

Kitchen table, five-house circle, family role split. Saver / Builder / Neighbor roles. Local resilience beats national collapse.

Why Now

By the end of 2025, the U.S. must refinance $6.4 trillion in debt.

Foreign demand is collapsing (China is dumping treasuries and buying gold). The Fed is cutting rates not for you, but to roll over that mountain of debt cheaper.

This isn’t theoretical — it’s the moment where every empire in history starts cannibalizing its own people to keep the system alive. The bailout engine turns inward.

Closing: The Choice

You can’t stop the cycle. But you can step off the treadmill.

Compression is real. The dollar’s collapse is baked in.

What matters is whether you ride it down — or build equity, reserves, and community to ride it out.

This is how we flip the leverage:

Not waiting for the system to save us.

Not gambling on Fed pivots.

But building stability from the ground up.

CTA

🗝️ Subscribe to follow the braid.

📎 Share this with someone staring at their rent hike.

🎩 Tip the Hat Back.