THE DECK | The Commander Stands Still

A Tariff, a Truck, and a Tale of Inventory Control Disguised as Policy

The Commander Stands Still

A Tariff, a Truck, and a Tale of Inventory Control Disguised as Policy

The Silent Strike

The White House’s new 25% import tariff on medium and heavy trucks arrived without a speech—just a memo and a market ripple. It’s being sold as a protection measure for domestic jobs and Made in America production. But what it really does is far more complex—and far more revealing.

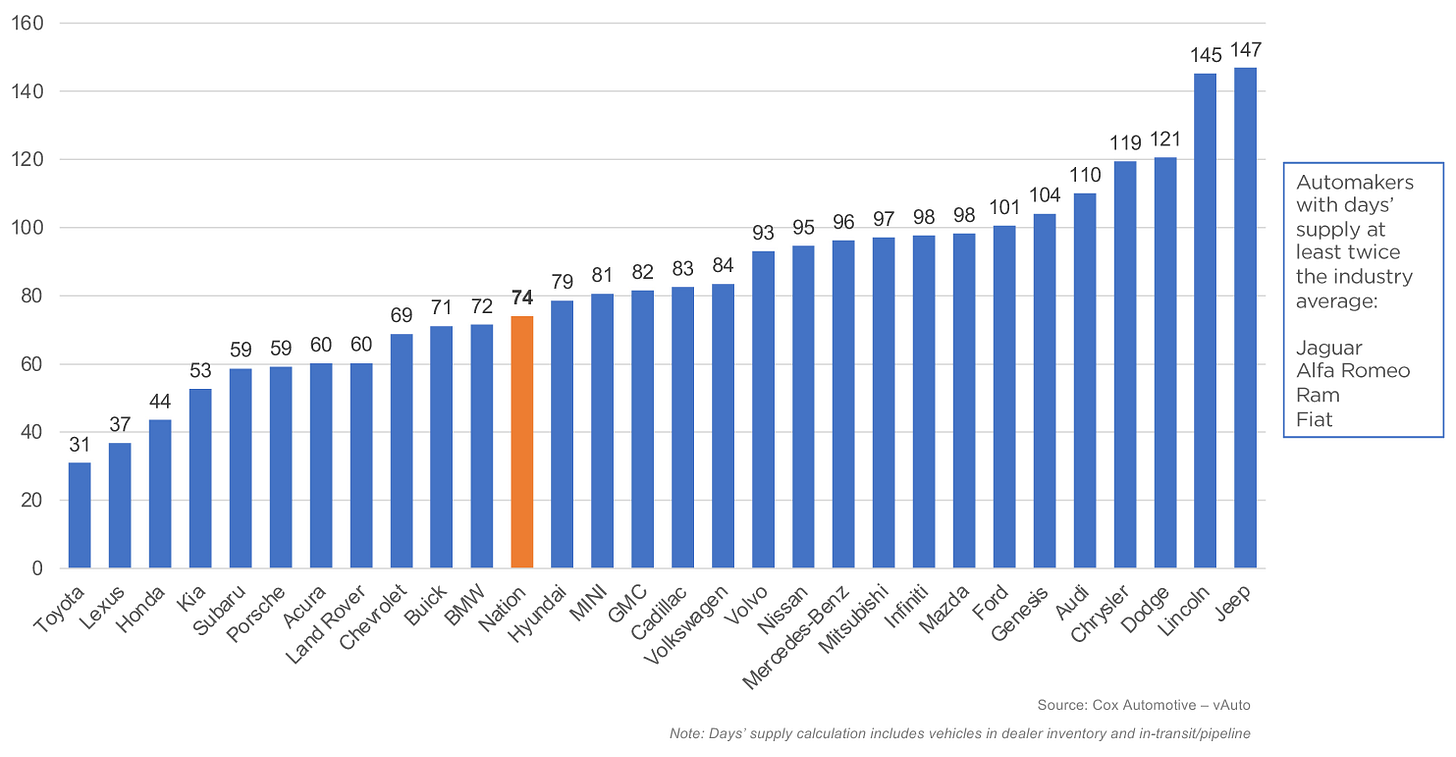

The tariff lands at the exact moment the U.S. auto industry is sitting on mountains of unsold inventory and an economy quietly sagging under subprime vehicle debt. Every dealership lot in the country tells the story: units financed on paper, not income. Buyers already upside down on their last note, now paying for two trucks they’ll never own outright.

Tariffs change headlines, not fundamentals.

A Jeep Named Collateral

The Jeep Commander, a once-proud export of Mexico’s Toluca plant, has become the symbol of the system’s contradiction. Built for global markets, the Commander was designed to bridge the SUV and pickup—exactly the kind of vehicle now caught in the new tariff crossfire.

Every unit rolling off that line now faces an artificial 25% wall just to reach its primary market. The truck didn’t change. The math did.

For Stellantis, that means margins collapse overnight.

For workers in Toluca, it means layoffs dressed as “production adjustments.”

For U.S. dealers, it’s a stay of execution—they can raise prices, delay shipments, and call it patriotism.

This isn’t trade war. It’s inventory control disguised as policy.

Inventory Mountains

📊 Auto Inventory Chart

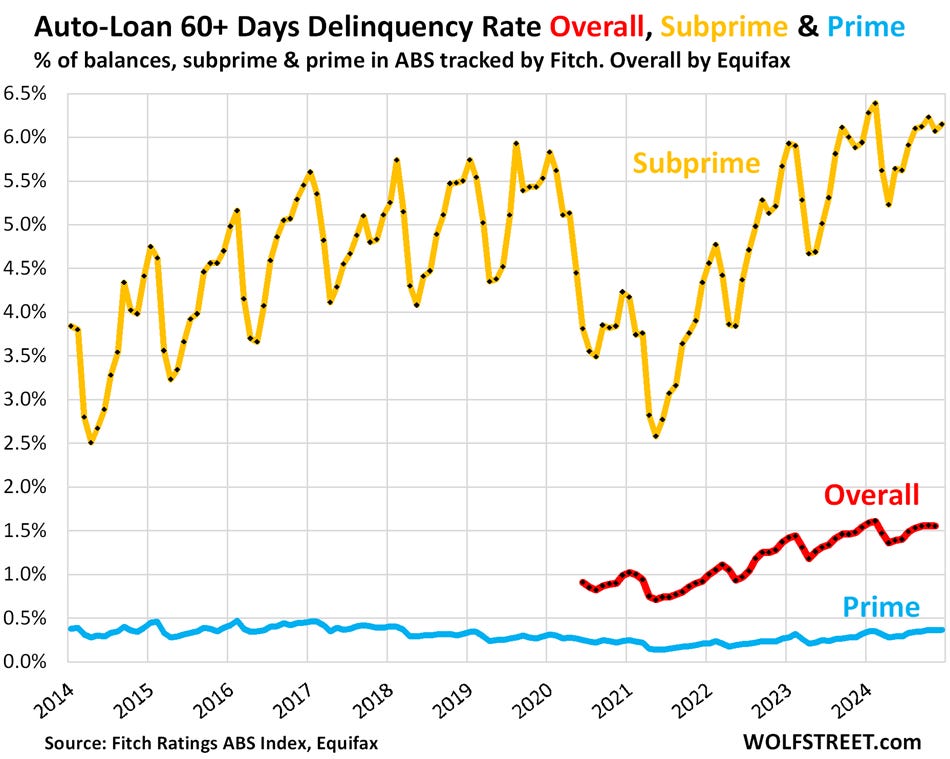

The Subprime Connection

The subprime auto and truck lending market was already cracking before this. Over 14% of new vehicle loans are delinquent. Repossession lots are full. Tariffs now act as a shock absorber—freezing foreign imports to stabilize resale values on domestic trucks and SUVs.

Short-term? It works.

Long-term? It’s poison.

Manufacturers stay solvent by sacrificing consumer choice.

Dealerships look solvent by holding depreciating assets.

The banks and funds underwriting it all quietly move to short futures on the same vehicles they financed last year.

📊 Delinquency Chart

The Mexico Equation

Mexico supplies roughly 80% of U.S. imported trucks. It’s not an adversary—it’s the supply chain. The Toluca, Saltillo, and Ramos Arizpe plants feed the very system this tariff claims to protect.

But Washington’s bet is that the system will rebalance before it breaks.

That’s a gambler’s fallacy.

The supply chain doesn’t stop—it reroutes.

Within weeks, you’ll see record “domestic” trucks assembled with 74% certified U.S. content—just under the USMCA minimum. The rest will come in parts disguised as “components,” avoiding the tariff. The law always leaves a loophole for the connected.

When the House Owns the Table

Every time this cycle repeats—housing, energy, tech, now autos—it follows the same script. The crisis isn’t an accident; it’s an extraction. The people writing the rules already own the game board.

They’re not protecting the worker.

They’re protecting the balance sheets of the lenders who financed the problem in the first place.

Tariffs are just how they say grace before the next feast.

What Comes Next

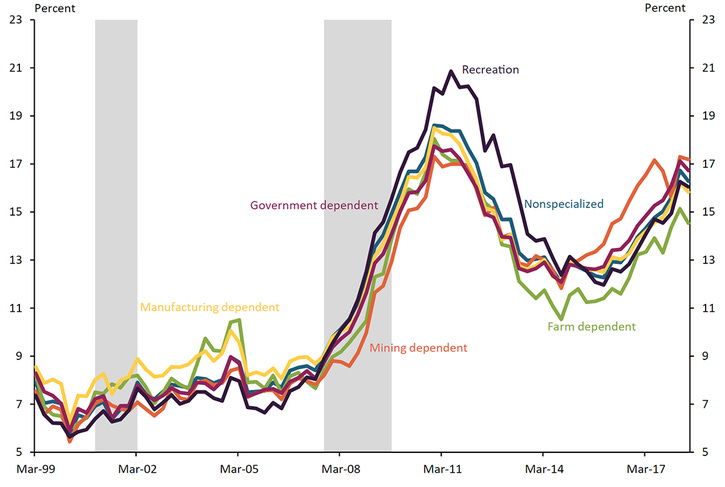

You’ll hear phrases like:

strategic reshoring

manufacturing renaissance

economic patriotism

But behind the slogans is an old trick: compress demand, inflate scarcity, and hand the public a new payment plan.

📊 Affordability Chart

The next wave of headlines will celebrate job creation. The real story will be supply attrition—Tier-2 and Tier-3 suppliers folding quietly while conglomerates absorb their assets.

The new economy is built to consolidate, not compete.

The Commander Stands Still

Somewhere in Toluca, a row of Jeep Commanders sits under halogen floodlights. Engines sealed. Tires waxed. Every one of them waiting for a buyer that might not come.

They’re not unsold—they’re proof of policy.

And that’s the quiet metaphor of this moment:

Even the most engineered machine can’t move when the ground shifts beneath it.

🧩 The Quiet Part

Every ban, bailout, or lawsuit hides the same move—someone takes a “small” stake that silences a bigger story. Five percent is enough to buy the room.

When influence is fractionalized, accountability evaporates.

That’s how pay-to-play becomes policy.

🃏 Truth Engine | CreatorHuman ™ TJ Baden