OFF DECK | And The One Word from Mr Buffett

THE DECK | Ok Two Words From ME and my Truth Engine 2550™ Then Warren

WORDS FOR A GUN TJB CREATORHUMAN ™

1.21.25 9.34am adapted modified lyrics and remixed for issue #163 substack

OFF DECK | How I wake up these days that last a week

TJ Baden CreatorHuman ™ OFF DECK | THE DECK

3:07 a.m. with a Headache, a Body Ache, and a Song in My Heart

11/21/2025

I’ve got friends in four places still playing on state visits

while fly-bys and victims collide.

Perfume in the air.

Blood in the sand.

And the joke is somehow still on the planet.

No wonder I’ve got a headache.

Perfume Gate & the Piggy Show

We’re supposed to pretend this is normal:

The stinky king shows up in another gold room, Miss Piggy at the podium, everyone huffing duty-free perfume like it’s moral sanitizer. They keep spraying the air while the stench underneath is still the same:

cover-ups,

“jokes” about violence,

threats tossed around like confetti,

and a long, ugly history trailing behind the motorcade.

We’re told not to worry.

We’re told it’s just politics.

We’re told not to notice that every “oops” seems to land on the bodies of women, children, immigrants, and anyone standing between the king and his next grift.

Miss Piggy steps up and calls it leadership.

I call it what it is: podium disinformation with a blowout and a law degree.

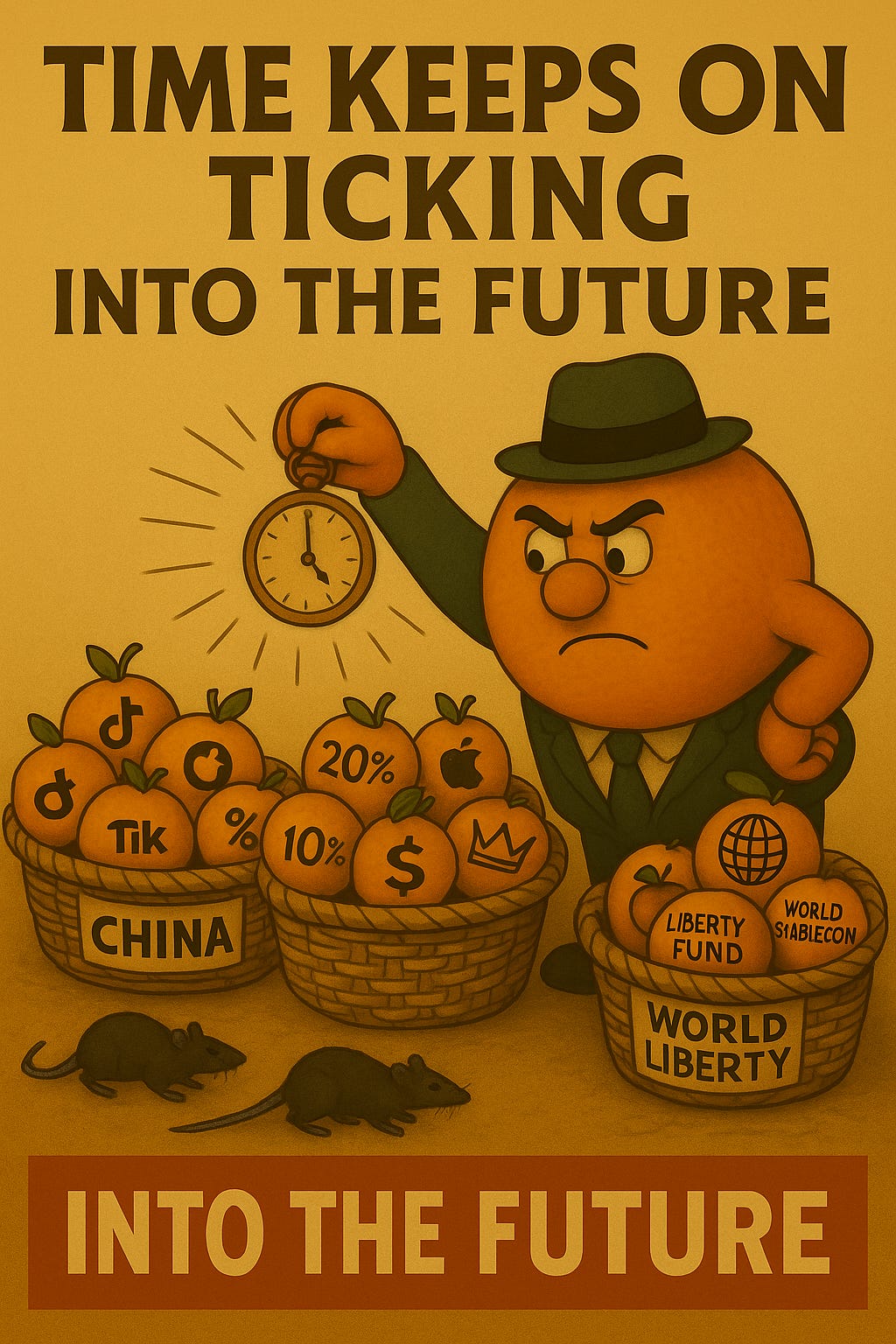

Circular Finance, Circular Lies

Welcome to Circular Financing:

Where AI is AI and then some,

the Treasury is the Fed,

the Fed is the Treasury,

and $1.8 trillion of our money gets treated like foreign income because… reasons.

Communism? Capitalism?

At this point, it’s just the United States of Asset Extraction: USA, EUA, Russia — everybody running the same script:

Sell off the future,

rename it “innovation,”

and ask the public to clap while they sign away the last pieces of the commons.

Data centers are the new oil fields.

We’re not just selling product — we’re selling people by the terabyte.

And we haven’t even finished building half of it yet.

Gnomes, Jets & Face Tattoos

No wonder the Famous Gnome is on the line with the Coast Guard asking if she can get face tattoos — dogs and cats — while it’s raining actual dogs and metaphorical cats out here.

The jets keep flying, the parade keeps rolling, the marching band hits its mark. And somewhere in Idaho, the order goes through for 49 of our best jets and some extra chips on the side so we can participate in:

sedition,

treason,

and the fattening of the king’s stool.

Ice Air Force, FIMA Games, Thanksgiving Day float — different costumes, same plot.

Season 2, Same Episode

We flip channels and land back on Bondi & the Files, Season 2:

Twelve months later, the boxes crawl back onto her desk like haunted set dressing. She’s waiting for cash, for PayPal, for applause, for someone to pretend this is all brand new.

“We found no files. We never saw the files. We don’t even know what a file is.”

Meanwhile, she “forgets” she signed the thing she says she never saw, just in case she needed both versions of the truth.

Unpresidential and unprecedented have quietly merged into the same word:

“Whatever.”

Ms. Piggy, the Podium & the Island

We watch the temper tantrums of men who treat bodies like property and power like a birthright.

The podium defender rebrands herself as Miss Piggy, explaining away threats and abuse like she’s reading a recipe:

a pinch of denial,

a dash of victim-blaming,

and a full cup of “Well, actually, the Democrats shut down the government.”

Her big win?

“We cut 95% of the education department and the schools are still open. See? Waste and fraud.”

No.

What you did is dumb down the supply chain.

You turned kids into inventory and called it efficiency.

Low spark on the high-heel boys, indeed.

And still nobody wants to talk about the island.

Funny how all roads lead there, but the GPS keeps “losing signal.”

The House with the Hole

Meanwhile, the House of White and Gold has a spiritual sinkhole and probably actual asbestos. Even the mice won’t go in.

But go ahead, hang some more flags.

Swap in a new set of podiums.

Pretend the problem is tone, not rot.

If we keep letting this run, the picture frames in the hall will fill with new symbols:

One letter away from where we’ve been before.

Swastikas don’t need permission; they just need enough people to look away and say,

“Surely somebody else will stop this.”

Treasury, Japan & the Guitar in the Middle

And now, about the Treasury and Japan, while my head throbs and I still hear guitar chords:

Japan was once “our friend” in the way markets mean “friend” — a convenient partner in the global carry trade, buyer of our debt, player in the great circular money loop.

I got my first guitar there — a copy so good it triggered lawsuits.

That’s the whole system in one object:

the original and the copy,

the brand and the lawsuit,

the music and the money welded together.

Today, we’re running the same pattern at sovereign scale:

We print,

they buy,

we pretend the numbers are real,

and call it “stability.”

Circular finance. Circular politics. Circular lies.

The Media Company Gravity Forgot about

On the bright side, the king’s media company is still trading where it started: about 10.39.

The only tiny issue is that it lost roughly 70% of its value on the way there — just like his poll numbers, approval numbers, and moral credit score.

All circular.

All connected.

All pretending gravity is optional.

So he puts on the Ronald McDonald suit, works on his stand-up routine, and hands the “serious” act to JD Vance, who’s suddenly trying on presidential drag after spending years living under someone else’s brand.

The world is terrified and laughing.

We’re terrified and starving.

And they call that “both sides.”

The Deck | content remix UNFTR and Warren Buffett edits and humor by GPT

Micro-Explainer: Treasury, Bessent, Japan (Plain Talk)

You asked to explain the Treasury / Bessent / Japan loop, so here’s the simple version you can drop later as OFF DECK side-copy:

For decades, Japan has recycled its savings into U.S. debt, helping keep our interest rates lower than they’d otherwise be.

The U.S. Treasury prints the promises, the Fed manages the flow, and global investors (including Japan) buy the story.

When investors like Bessent (and others like him) start questioning the stability of U.S. power, law, or trade policy, they don’t yell about it — they quietly shift money.

Those shifts show up before headlines: in bond yields, currency moves, and capital flows — exactly the stuff regular people never see until it’s too late.

You can think of it like your first Japanese guitar:

If the copy is better than the original and the lawyers start asking who really owns the sound,

the entire band has to stop and renegotiate the song.

THE DECK | Warning from Warren Buffet mixed in with some UNFTR mish mashed and smashed - condensed so I can understand it. TJB

Let me speak plainly.

After six decades watching markets, studying businesses, and tracking how courts quietly redirect the flow of global capital, I’ve learned one truth that never fails:

The worst mistake any investor can make is underestimating a judicial signal.

And last week, in a ruling related to Donald Trump’s tariff authority, the courts dropped a single word that most people shrugged off. They shouldn’t have. That word is a fuse — slow-burning, structural, and already moving capital around the globe.

The word was:

imports.

Not poetic. Not dramatic. But devastating in its simplicity.

The statute Trump used to justify years of tariffs — the International Emergency Economic Powers Act (IEEPA) — never once contains that word. Never authorizes tariffs on imported goods. Never grants a president the unilateral right to rewrite America’s trade architecture without Congress.

To an everyday citizen, that sounds like a technicality.

To global markets, it’s an earthquake under a trillion-dollar bridge.

Because if the legal foundation for those tariffs was never solid, then everything built on top of them — supply chains, pricing models, investment decisions, cross-border contracts, manufacturing relocations — suddenly becomes uncertain.

And uncertainty is the most expensive commodity on earth.

Why this matters more than politics

This isn’t about loving or hating Donald Trump.

🔥 BILLIONAIRES BALL

Jeffries said the quiet part out loud —

and now he’s getting his name etched on the Ball.

The American people have spoken.

And if there’s any justice left,

MAGA will finally follow suit

while Trump drops the flag he never carried.

This is what happens when the truth walks in:

the billionaires stop dancing,

and the people start leading.

— TJB | CreatorHuman™

Truth Engine 2550

And now we are back…TJB

Markets don’t trade on feelings.

They trade on:

authority

predictability

legal clarity

and who actually has the power to do what

When courts say, “No, emergency powers don’t cover this,” the ripple isn’t political — it’s constitutional. And constitutional corrections hit markets harder than financial ones, because they rewrite the operating rules.

The court didn’t destabilize anything.

It simply reminded everyone where power actually sits.

Congress sets trade rules.

Presidents don’t get to improvise them.

And when the judiciary reasserts that boundary, capital has to reprice the world it lives in.

Quietly at first.

Then obviously.

This is how money whispers before it runs

Professionals have already started repositioning:

Bond markets twitch before headlines understand why.

Equity rotations shift into defensive positions.

Multinationals freeze hiring, pause expansions, and delay capital spending.

CEOs start asking if their 5-year supply chain rebuild was based on… sand.

Foreign governments recalculate: Were we reacting to a power the president didn’t actually have?

None of this shows up on cable news.

It shows up in spreadsheets.

And whispered calls.

And options pricing.

And the feeling that something big is moving just beneath the surface.

We are in that phase now — the quiet stage.

The backward shock nobody is ready for

If courts continue down this path, the next question becomes:

Were the tariffs themselves legally valid?

And if not — what happens to the billions companies paid?

Refund claims.

Litigation.

Earnings revisions.

Valuation resets.

A multi-year legal and economic recalibration.

Not panic — recalculation.

This is how real corrections start.

Not with screaming.

With stillness.

With everyone hitting pause at the same time.

And that pause creates the conditions for sudden movement later.

The deeper truth: America’s “improvised economy” just hit its limit

For twenty years, Congress has failed to legislate the big stuff: trade, immigration, energy, national security.

Into that vacuum, presidents from both parties stepped in and stretched executive power to fill the gap.

Markets adapted.

They got used to government-by-improvisation.

Until now.

Because courts eventually correct imbalances — not out of politics, but out of constitutional duty.

And when they do:

authority shrinks

predictability shrinks

stability shrinks

and capital moves

Always.

What’s coming next

This isn’t a crash call.

It’s not a doomsday alarm.

It’s a repricing — a constitutional one — the kind that restructures markets from the inside out.

Here’s the pattern every major correction has followed since the 1960s:

Judicial signal (we just got it)

Bond market murmurs

Equity rotation

Capital freeze

Litigation risk

Supply chain reconsideration

Policy rewrite

Volatility spike

History books ask: why didn’t anyone see this?

We’re between steps 1 and 3.

Most people won’t notice until step 6.

By step 9, the sovereign funds, pension giants, and hedge managers will already have repositioned.

The takeaway

This isn’t panic time.

This is attention time — the difference between emotion and strategy.

Because when the judiciary reminds the market that constitutional rules still matter, markets always respond the same way:

They correct.

Quietly… then loudly.

We are still in the quiet part.

And by the time it gets loud, the smartest capital in the world will already be moving.

Stay aware.

Stay steady.

Stay smart.

NOV 4. NOV 18. 2025.

Two days. Two strikes. One truth:

the moment you finally see the power of destiny—

and hear fate itself become the battle cry

in a war fought over faith.

Because some days don’t pass.

They mark you.

They carve the line where everything before was confusion

and everything after is purpose.

And now you know exactly which side you’re on.

When we look far above the noise — 25 years out —

only then can we begin to build again.

Until then, we fight like there is no alternative.

Because there isn’t.

We don’t have a choice.

We have our voice.

And words are our bullets.

TJB • 11.22.25

TJ Baden — CreatorHuman™

TRUTH ENGINE 2550™

9:54; While you burning cole..a black left hole behind me says Fuck Robert E. Lee. OUR HOUSE still all colors… your ass is behind..but were kind it’s never be too late to say goodbye! Now Get the fuck out!!! TJB OUR HOUSE

From My Browser - unpublished works; https://www.creatorhuman.com/p/executive-summary-business-oriented